"Xing certificate solid collection and debt transfer" to expand the nut category of melon head - precisely the value of debt investment analysis

Key points of investment

Just the terms of the convertible debt (issue size 1.430 billion yuan, rating AA) are more conventional, the debt floor protection is better, the current parity of its first day of listing to obtain the share transfer premium rate in the 18%-22% range, the price is 123-127 yuan. Under the assumption of 60% of the allocation, the size of the debt transfer left to the market is 536 million yuan, with a projected sign-off rate of 0.006%.There is no objection to playing new participation. The growth of food performance can still be maintained, short-term uncertainty comes from valuation, investors can wait for their bonds to be listed in combination with the situation to consider whether to participate.

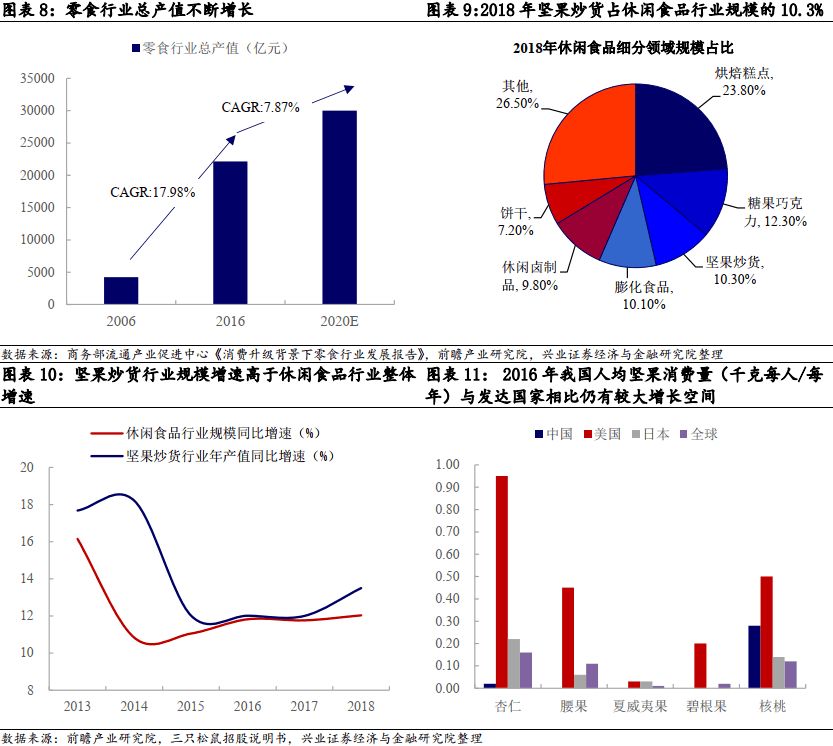

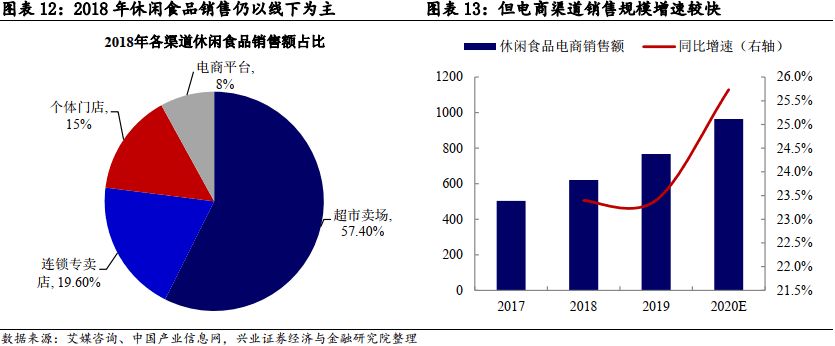

Founded in 2001, the main product is to negotiate melon seeds, the development process of its innovative melon flavor, from 2016 into the mixed nuts track, the introduction of small yellow bag daily nuts and other products, such products revenue ratio increased from 0.64% in the current year to 17.06 percent in 2019.The profitability of sunflower products is strong, the gross margin is stable at 33%-35%, the gross margin of nut products is low (20H1 is 26.92%), and 20H1 contributes 75%/11% of gross margin respectively. It is important to note that the latter has benefited from the increased scale effect and increased gross margin of production line automation, with 20H1 already surpassing its main competitors by three squirrels and good shops.The Snack Industry Development Report in the Context of Consumption Upgrade shows that the total output value of China's snack industry is on a rapid upward trend, with a compound growth rate of 17.98 percent from 2006 to 2016, and the total output value of the industry is close to 3 trillion yuan in 2020. In terms of category structure, casual foods include baked pastries, nut stir-fry, candy chocolate, puffed food, etc., of which in 2018 the sales of nut stir-fry, where the food is located, accounted for 10.3% and the scale of growth was faster.In addition, from the country comparison, in addition to walnuts, China's other major nuts per capita consumption is not as high as the United States, Japan and the world average, nut consumption still has a huge room for growth. Supermarkets, specialty stores and individual stores remain the main sales channels for leisure food in 2018, but e-commerce channel penetration has increased from 0.3% in 2013 to 8.0% in 2018 and is expected to continue to improve.

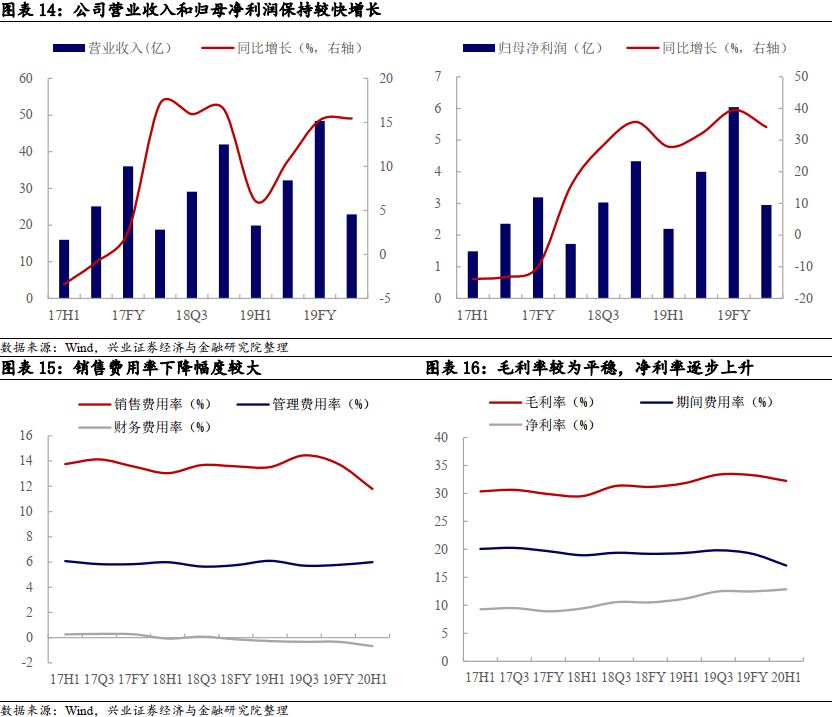

2020H1 company realized operating income / attributable net profit of 2.294/ 295 million yuan, an increase of 15.45 percent / 34.09 percent year-on-year.During the reporting period, its sales growth rate of traditional melon seeds/original melon seeds/caramel, pecans and other blue bag melon seeds was about 19%/30%/20%, the proportion of red bags/traditional melons with lower gross margin increased, and the proportion of high gross margin blue bags decreased resulting in a gross margin of 33.09% for sunflower products, a decrease of 2.19pct year-on-year. The scale effect of the nut category has been strengthened, the automation of the production line has been increased, and the company's overall gross margin has been increased by 32.23%, up 0.41pct year-on-year, relying on the continuous improvement of the gross margin of nuts. 20H1 company's sales expense rate of 11.51 percent, a continuous decline month-on-month, mainly due to the continuation of the impact of public health events, costs have not yet returned to normal, in this case the company's net interest rate reached 12.86 percent, an increase of 1.69pct year-on-year.

Risk Warning: Macroeconomic decline, food safety problems, failed expansion of categories, rising raw material prices.

The body of the report

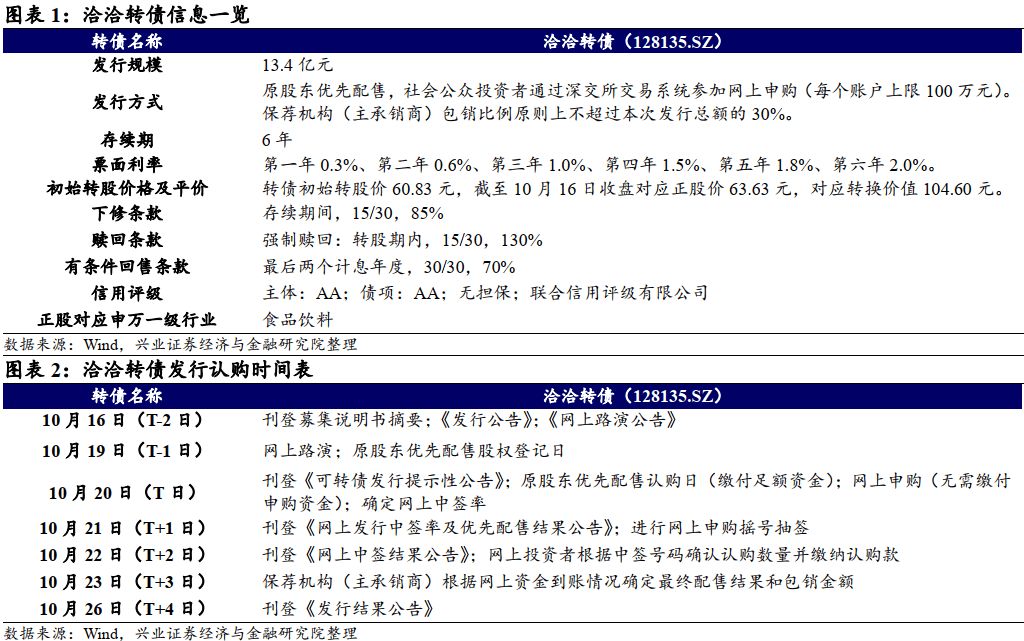

On the evening of October 15th, the announcement of the food announcement will be issued online on October 20th, 2020 1.34 billion yuan convertible bonds, and the funds raised (net of the issuance fee) will be the Ganzhou contact nut leisure food project (to be invested in raising 490 million yuan). ), Luzhou Tongan Nuts Leisure Food Project (260 million yuan), Changsha Tsing-Tsing Food Phase II Expansion Project (170 million yuan), China-Related Nut Research and Development and Testing Center Project (140 million yuan) and supplementary working capital (280 million yuan).

1

Negotiate new analysis and investment advice for debt transfer

The terms are regular and the debt base protection is better

Just the debt transfer terms are more conventional, according to the six-year AA corporate debt valuation of 4.77 percent, the maturity of 115 yuan redemption, the value of the pure debt of the debt is about 91.32 yuan, the face value of the corresponding YTM is 3.17 percent, the bottom of the debt protection is better. If all convertible bonds are converted at RMB60.83 of the share price, the diluted margin of the total share capital (100% of the outstanding shares) is 0.43%.

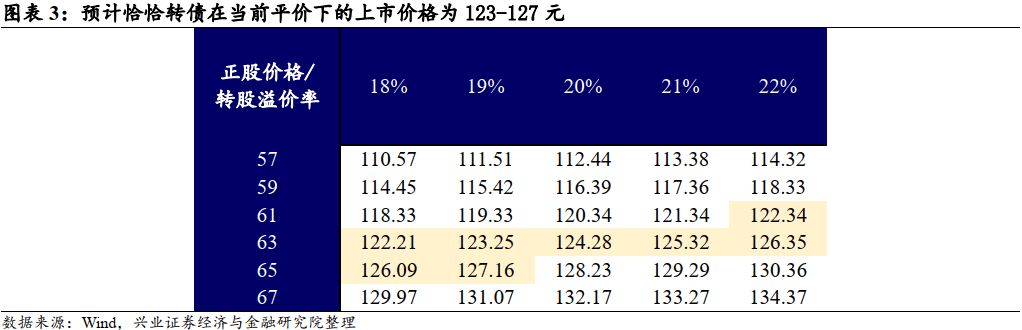

Statically, the first day of listing price is expected to be 123-127 yuan

As of The close of trading on October 16th, the convertible bonds were trading at 104.60 yuan. In the face of the gradual release of new food nut products, traditional melon products have also maintained sales resilience in the outbreak, it may be important to note that: 1) the valuation is high; Precisely convertible debt is a relatively scarce food category in the market, its positioning should be slightly higher than the parity of similar Zhang Bank convertible bonds (rating AA plus, balance of 2.498 billion yuan, parity 106.60 yuan corresponding to the price of convertible bonds 124.42 yuan).

Statically, it is expected that the current parity is precisely the first day of the transfer of bonds to obtain the share exchange premium rate in the 18%-22% range, the price of 123-127 yuan.

It is expected to have a 0.006% sign-off rate and actively participate

According to the latest data, the majority shareholder of China Food is Hefei Huatai Group Co., Ltd., which owns 41.64 percent of the shares, and the top ten shareholders hold a total of 64.11 percent. At present, no announcement disclosed the shareholders' intention to make a distribution, under the assumption of 60% of the allocation, the size of the debt left to the market is 536 million yuan.

Just transfer debt only set up online issuance. Recently issued Dong cable transfer bonds (AA, size 800 million yuan), Honglu convertible bonds (AA, size 1.880 billion yuan) online purchase of about 81.6/846 million households. Assuming that exactly the transfer of debt online purchase 8.5 million households, according to the full calculation of the sign-off rate of about 0.006%.

There is no objection to playing new participation. The growth of food performance can still be maintained, short-term uncertainty comes from valuation, investors can wait for their bonds to be listed in combination with the situation to consider whether to participate.

2

Negotiate food fundamentals analysis

Expand the nut category of melon taps

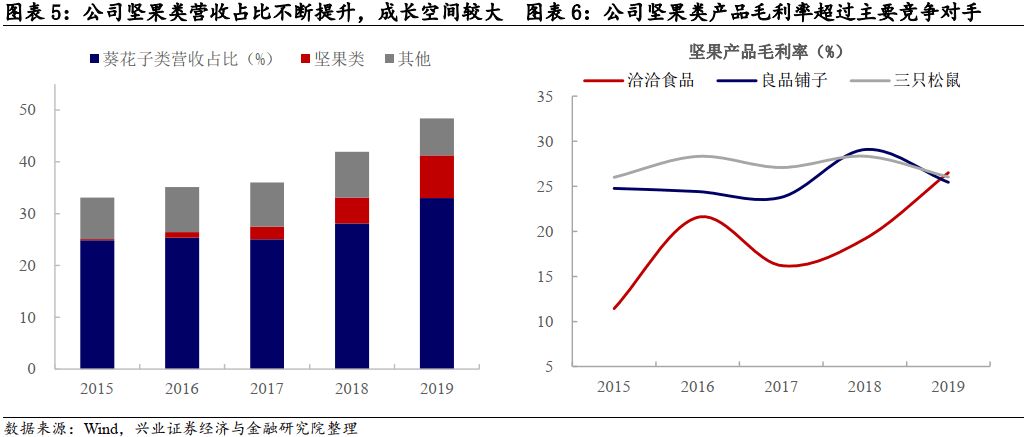

Contact food is a traditional fried goods, nuts as the main camp, set independent research and development, scale production, marketing as one of the modern leisure food enterprises. Founded in 2001, the main products for the negotiation of melon seeds, the development process of its innovative melon flavor (such as pepper salt, caramel, etc.).Since 2016, the company has entered the mixed nut circuit, launching a range of products such as small yellow bag daily nuts, which increased its revenue ratio from 0.64 percent that year to 17.06 percent in 2019, with a compound revenue growth rate of about 151 percent over four years.Daily Nuts is still in the Blue Sea phase of high demand, and the company is expected to continue to contribute to the increase with the release of new "Probiotic Daily Nuts" and "Daily Nut Oatmeal" in July 2020.

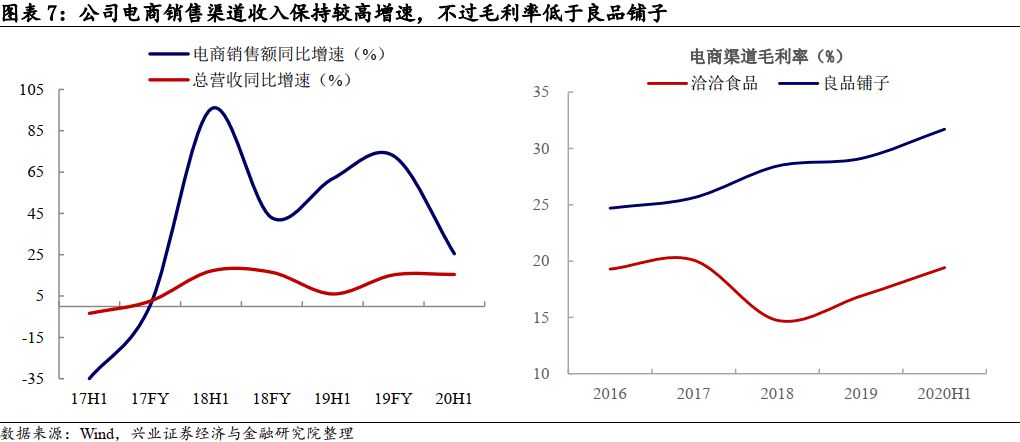

The profitability of sunflower products is strong, the gross margin is stable at 33%-35%, the gross margin of nut products is low (20H1 is 26.92%), and 20H1 contributes 75%/11% of gross margin respectively. It is important to note that the latter has benefited from an upward trend in gross margins due to increased scale effects and increased production line automation, with 20H1 already surpassing its main competitors by three squirrels and good shops.Sales scene, the company has a national offline sales network, offline sales scale industry first, and continue to deepen distribution, KA stores and other relatively mature channels of development capabilities. The company's offline sales in the South Central region accounted for the highest proportion of revenue, about 40%. The company's e-commerce sales rose to 11.60% of 20H1 from 5.55% in 2016, with a lower gross margin than the offline channel, but with an upward band.

The company has set up in China to Hefei, Puyang, Changsha, Chongqing, Langfang, Baotou, Gannan, Harbin-based eight production bases. In the first half of 2020, it set up a subsidiary in Zhangzhou, with a total investment of 600 million yuan, responsible for 100,000 tons of nuts and leisure food projects, and through the Chongqing Food Phase II Industrial Park Construction Bill, a total investment of 357 million yuan, after the completion of the annual output of 18,000 tons of melon seeds, raw melons Sub 3000 tons, pecans / caramel melon seeds 9000 tons, nuts 3000 tons, the annual production is expected to add 1 billion yuan in operating income, a total profit of 200 million yuan, the return on investment period of 6.7 years (including 2 years of construction period). In addition, the company's products are exported to Asia, Europe, the United States and other more than 40 countries and regions, in 2019 overseas investment in the construction of the first factory - Thailand plant successfully put into operation.

Nut category space is broad, e-commerce channel penetration is expected to increase

According to the Snack Industry Development Report of the Circulation Industry Promotion Center of the Ministry of Commerce, the total output value of the snack industry is on a rapid upward trend, with a compound growth rate of 17.98 percent from 2006 to 2016 and a total output value of nearly 3 trillion yuan in 2020. According to China Industry Information Network data, in 2019 the leisure snack industry CR3 was 26.85 percent, CR5 was 29.25 percent, CR10 was 32.91 percent, and in 2019 sales ranked in the top three are three squirrels/grassy/good shops.

In terms of category structure, casual foods include baked pastries, nut stir-fry, candy chocolate, puffed food, etc., of which the 2018 contact food is located in the nut stir-fry revenue ratio of 10.3% and belongs to the fast-growing areas.According to the China Food Industry Association, the industry's annual output value grew rapidly from 28.31 billion yuan to 121.40 billion yuan between 2007 and 2017, while CAGR was 15.7%, a faster growth rate than the leisure food industry as a whole. In addition, from the country comparison, in addition to walnuts, China's other major nuts per capita consumption is not as high as the United States, Japan and the world average, nut consumption still has a huge room for growth.

Supermarkets, specialty stores and individual stores remain the main sales channels for leisure food in 2018, but e-commerce channel penetration has increased from 0.3% in 2013 to 8.0% in 2018 and is expected to continue to improve.Online consumption has the characteristics of breaking through product categories and geographical restrictions, efficient distribution and strong price competitiveness, and caters to the demands of a new generation of consumers.

Product structure optimization and scale effect help improve profitability

In 2019, the company achieved operating income/home-to-home net profit of RMB4.837/604 million, up 15.25% YoY/ 39.49%。By product, the company's traditional red bag revenue reached more than 10% growth, mainly due to the sinking of the third and fourth-tier markets and county and township markets and weak market expansion; In 2019, e-commerce channels achieved revenue of 484 million yuan, a significant increase of 72.86 percent year-on-year, and the results of publicity such as live delivery were remarkable. The company's gross margin for 2019 was 33.26%, up 2.10pct year-on-year, mainly due to 18-year price increases, improved gross margin on nut products, and blue bag volume. In terms of expenses, advertising promotional expenses in sales expenses increased by 23.61% YoY, the largest increase, mainly due to cooperation between the company and Focus Media to increase publicity and delivery efforts; The Company's overall net profit margin for the reporting period was 12.48%, up 1.96 pct year-on-year.

2020Q1 Company realized net profit of 1.147/128 million yuan, up 10.29% YoY/ 48.48%, the expansion of melon snack attributes under the influence of public health events brought increments.In the current period, the company's core single products to maintain good demand, sunflower category Q1 yoY growth rate of 17%, blue bag YoY growth rate of about 20%, red bag growth rate of more than 15%. Benefiting from the continued improvement in gross margin of nut products and the increase in the proportion of blue bags, the Company's gross margin of 20Q1 was 32.12%, up 1.74pct YoY. 20Q1 sales costs decreased year-on-year, mainly under the influence of public health events, freight, travel, promotional expenses, etc. decreased, it is expected that the follow-up costs will be distributed evenly according to the company's development needs to each quarter.

2020H1 company realized operating income / attributable net profit of 2.294/ 295 million yuan, an increase of 15.45 percent / 34.09 percent year-on-year.During the reporting period, its sales growth rate of traditional melon seeds, raw melon seeds, caramel, pecans and other blue bag melon seeds was about 19%/30%/20%, respectively, the proportion of red bags/traditional melons with lower gross margin increased, and the proportion of high gross margin blue bags decreased resulting in a gross margin of 33.09% for sunflower products, a decrease of 2.19pct year-on-year. The scale effect of the nut category has been strengthened, the automation of the production line has been increased, and the company's overall gross margin has been increased by 32.23%, up 0.41pct year-on-year, relying on the continuous improvement of the gross margin of nuts. 20H1 company's sales expense rate of 11.51 percent, a continuous decline month-on-month, mainly due to the continuation of the impact of public health events, costs have not yet returned to normal, in this case the company's net interest rate reached 12.86 percent, an increase of 1.69pct year-on-year.

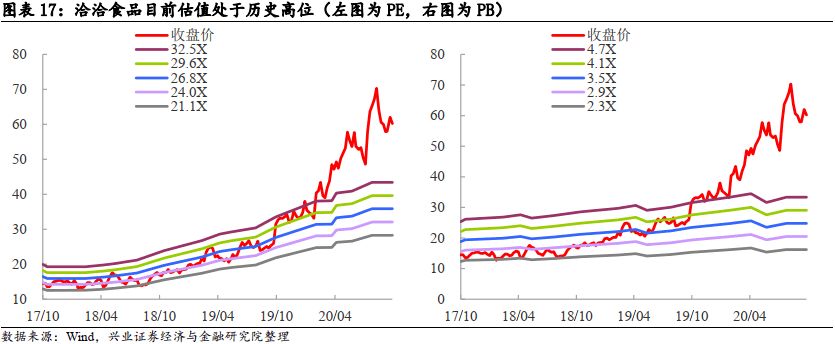

Positive stock valuations are at record highs

As of October 16th, the food PE (TTM) was 47.6 times, and the PB (LF) was 8.96 times, with a valuation slightly higher than the central level of leisure food (THE CITIC secondary industry) and at an all-time high in vertical terms. At present, the company's share price is not subject to the pressure of the release of shares, the valuation pledge ratio is low

Xingxing food and beverage team in the report "Contact food 20H1 in the review: traditional melon volume, profitability to maintain the improvement" mentioned that the company's internal system optimization (business division and amiba model), new product release trend is good, the core melon sub-category structure is constantly optimized, overlay automation The increase in the rate of nut gross margin, we adjusted the company's earnings forecast based on the company's in-earnings report, its 2020 revenue and net profit is expected to be 5.546 billion yuan (-14.7%) and 741 million yuan (-22.8), respectively %)。 Corresponding to the closing price on August 10, 2020, the Company maintained a "prudent increase" rating of 44x for 20 years.

Risk Warning: Macroeconomic decline, food safety problems, failed expansion of categories, rising raw material prices.

Related reports

Xing certificate solid collection and debt transfer can be a little ahead of the value

What does it mean to re-emerge the undervaluation of new securities?

Analyst statement

Note: The report is based on the research report published publicly by Henyep Securities Economics and Finance Research Institute, the details of the report and related risk tips can be found in the full version of the report.

Securities Research Report:Expand the nut category of melon taps- Just the value analysis of the investment value of the debt transfer》

Published: October 16, 2020

Report issuer: Henyep Securities Co., Ltd. (qualified for securities investment consulting business approved by the CSRC)

Analysts for this report:

Huang Weiping SAC License Number: S0190514080003

Zuo Dayong SAC License No.: S0190516070005

Research Assistant:Thunder.

(1) Risk tips and legal notices for the use of this study

Henyep Securities Co., Ltd. has been approved by the China Securities Regulatory Commission, has qualified for securities investment consulting business.

This report is for the use of customers of Henyep Securities Co., Ltd. (the "Company") only and the Company does not treat the recipient as a customer if he receives this report. The information, opinions, etc. in this report are for the information of the client only and do not constitute an offer or invitation or offer for the sale of the securities in question. Such information and opinions do not take into account the specific investment objectives, financial situation and specific needs of the persons who obtained this report and do not constitute a personal recommendation to anyone at any time. Clients should independently assess the information and opinions contained in this report, taking into account their investment objectives, financial situation and specific needs, and consult experts on legal, commercial, financial, taxation, etc., as necessary. The Company and/or its associates shall not be liable for all consequences a result of the basis or use of this report.

The source of the information contained in this report is considered reliable, but the Company does not warrant its accuracy or completeness, nor does it warrant that the information and recommendations contained theret will not change. The Company is not responsible for any direct or indirect loss or any other loss in connection with the use of the materials contained in this report.

The information, opinions and assumptions contained in this report only reflect the Company's judgment on the date of publication of this report, the price, value and investment income of the securities or investment targets referred to in this report may rise or fall, past performance should not be used as a basis for future performance; At the same time, the Company may make changes to the information contained in this report without notice, and investors should pay their own attention to the corresponding updates or modifications.

Unless otherwise noted, the data on performance cited in this report represent past performance. Past performance should not be used as a presctic of future returns. We do not promise or guarantee that any foreshadowed returns will be realized. The return forecasts made in the analysis may be based on the corresponding assumptions. Any change in assumptions may significantly affect the predicted returns.

Our sales, trading and other professionals may make oral or written market comments and/or trading opinions that are inconsistent with the opinions and recommendations of this report, based on different assumptions and standards and using different analytical methods. The Company has no obligation to update all recipients with this opinion and recommendation. The Company's asset management, self-employed and other investment business units may independently make investment decisions that are inconsistent with the opinions or recommendations contained in this report.

The copyright of this report belongs to the Company. The Company reserves all rights to this report. Unless otherwise shown in writing, the copyright of all materials in this report belongs to the Company. No part of this report may be made in any way, copied or reproduced in any way, distributed to any other person, or used in any other way that infringes the Copyright of the Company, without the prior written authorization of the Company. The Company shall not be liable for unauthorized reproduction.

Where permitted by law, Societe Generale May hold and trade securities positions mentioned in this report, or may provide or seek to provide investment banking services to such companies. Investors should therefore take into account the potential conflicts of interest that hymn Securities Co., Ltd. and/or its related personnel may have affecting the objectivity of the views in this report. Investors should not view this report as the sole reliance on investments or other decisions.

(2) Investment rating description

The ratings covered by the investment recommendations in the report are stock and industry (unless otherwise noted). The rating criteria are the rise and fall of the company's share price (or industry index) in the 12 months following the release of the report, compared with the representative index of the relevant securities market during the same period, with the A-share market above the Composite Index or the Shenzhen Composite Index as the benchmark.

Industry rating: recommended - relative performance is better than the representative index of the relevant securities market during the same period; neutral - relative performance is flat with the representative index of the relevant securities market during the same period; avoidance - relative performance is weaker than the representative index of the relevant securities market during the same period.

Stock rating: Buy - relative to the same period of the relevant stock market representative index rose more than 15%; prudent increase - relative to the same period of the relevant stock market representative index rose between 5% and 15%; neutral - relative to the same period of the relevant stock market representative index rose between -5% to 5%; This prevents us from giving a clear investment rating.

(3) Disclaimer

The market is risky and investments need to be cautious. The contents and opinions contained in this platform are for informational purposes only and do not constitute investment advice to any person (presentations, exchanges or minutes of meetings by experts, guests or other persons other than Henyep Securities Co., Ltd.) and do not constitute any guarantee that the recipient shall not rely solely on the information in this material to replace his or her own independent judgment and shall make investment decisions at his own discretion and at his own risk. According to the Measures for the Proper Management of Securities and Futures Investors, the contents of this platform are for the use of professional investors among the clients of Henyep Securities Co., Ltd., if you are not a professional investor, in order to ensure the quality of service and control investment risk, please do not subscribe to or reproduce the information in this platform, this information is difficult to set access rights, if you cause inconvenience, please understand. Under no circumstances shall the author and the author's team, Societe Generale Limited, be liable to anyone for any loss a resulting from the use of any content on the Platform.

The purpose of this platform is to communicate research information and exchange research experience, is not the publishing platform of the research report of Henyep Securities Co., Ltd., the published views do not represent the views of Henyep Securities Co., Ltd. Any complete research opinion shall be subject to a report officially issued by Henyep Securities Co., Ltd. The content contained on the Platform only reflects the author's judgment on the date of the full report or on the date of publication of the Content of the Platform and may be changed at any time without notice.

The contents contained in this platform do not constitute a judgment or investment proposal on the specific price level, specific time point, specific market performance of specific securities, and cannot be equated with operational opinions guiding specific investments.

Go to "Discovery" - "Take a look" browse "Friends are watching"